بمجرد استخدامك لهذا الموقع، فإنك توافق على الالتزام بكافة شروط وأحكام

الاستخدام الواردة أدناه ("الشروط والأحكام"). ويحق لـشركة مضاربة المالية

("مضاربة المالية") تعديل أو تغيير هذه الشروط والأحكام في أي وقت تراه

مناسباً. ويكون مستخدم هذا الموقع ("المستخدم") ملتزمًا بتلك التعديلات أو

التغييرات سواء أطلع عليها من قبل أم لم يطلع. وفي حالة عدم موافقة المستخدم

على هذه الشروط والأحكام، ينبغي عليه عدم استخدام هذا الموقع تماما.

يجب على المستخدم قراءة هذه الاتفاقية بعناية حيث توضح تفاصيل الخدمة التي

تقدمها مضاربة المالية وتحدد الالتزامات والحقوق بين مضاربة المالية

والمستخدم. ويمنع استخدام المنصة في حال عدم فهم واستيعاب كافة مواد

الاتفاقية.

1. التعريفات:

● مضاربة المالية: شركة مضارية المالية تأسست وفقاً لنظام

الشركات السعودي، بموجب سجل تجاري رقم 1010560120، والمرخص لها من قبل هيئة

السـوق المالية ضمن مختبر التقنية المالية بتاريخ 2020/5/5م و عنوان الشركة هو

المملكة العربية السعودية.

● المستخدم: هو الشخص الطبيعي أو الاعتباري أو المفوض

للمستفيد من خدمات المنصة والذي استكمل خطوات التسجيل بنجاح في المنصة.

● المنشأة ذات الغرض الخاص

: تعني المنشأة التي يتم انشاؤها بموجب القواعد المنظمة

للمنشاّت ذات الأغراض الخاصة و المتعلقة باستثمار معين.

● المنصة أو مضاربة: منصة مضارية المالية بناءً على قرار

مجلس هيئة السوق المالية الصادر بتاريخ [•] وهي عبارة عن منصة إلكترونية

مملوكة للمنشأة ذات الغرض الخاص تقدم من خلالها طرق تمويل عن طريق ربط

المستثمرين بطالبي التمويل.

● الموقع الإلكتروني: https://mudaraba.sa/ و أي نطاق آخر

متصل به أو متفرع عنه.

● نظام الشركات: نظام الشركات الصادر بالمرسوم الملكي رقم

(م/٣) وتاريخ ٢٨/١/١٤٣٧ هـ وأي تعديلات تطرأ عليه.

●

القواعد المنظمة للمنشاّت ذات الأغراض الخاصة:

تعني القواعد الصادرة عن مجلس هيئة السوق المالية بموجب القرار رقم 4-123-2017

وتاريخ 09/04/1439 ه الموافق 27/12/2017 م بناء على نظام السوق المالية الصادر

بالمرسوم الملكي رقم م/30 وتاريخ 02/06/1424ه المعدلة بقرار مجلس هيئة السوق

المالية رقم 1-7-2021 وتاريخ 01/06/1442ه الموافق 14/01/2021م.

●

الاستثمارات

: تعني الاستثمارات التي تتم بموجب اتفاقية مضاربة تبرم فيما

بين المنشأة ذات الغرض الخاص والمستثمر.

● طالبي التمويل: الشركات أو المؤسسات الذين يطلبون التمويل

من خلال المنصة.

● أطراف ذو علاقة: يعتبر أطراف ذو علاقة الأشخاص التاليين:

- مديري المنصة و موظفيها

- أعضاء مجلس إدارة الشركة أو أي من شركاتها التابعة وأقاربهم

- التنفيذيين في الشركة أو أي من شركاتها التابعة وأقاربهم

- الشركات التي يملكها أو يكون أي من أعضاء مجلس إدارة الشركة أو التنفيذيين

في المنصة أو أقاربهم شريكًا فيها أو عضوًا في مجلس إدارتها أو من التنفيذيين

فيها أو يملكون ما نسبته (5%) وأكثر من رأس مالها أو أسهمها أو لهم تأثير في

قراراتها ولو بإسداء النصح أو التوجيه.

- أي من مساهمي الشركة.

● المستثمر: المستخدم الذي استثمر في الفرص المعروضة من خلال

المنصة.

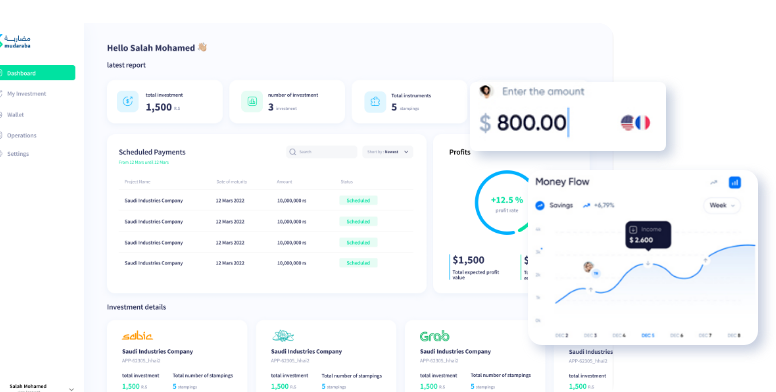

2. مضاربة (علامةتجارية):

مضاربة هي عبارة عن منصة الكترونية تقدم طرق تمويل عن طريق ربط المستثمرين

بطالبي التمويل ("مضاربة") وتعتبر جميع المعلومات والمعايير المدرجة في مضاربة

جزء لا يتجزأ من مضاربة المالية. لا تقدم مضاربة في التحليلات التي تقوم بها

على أي تحليل للأوراق المالية، بالإضافة إلى أنها لا تقدم أي استشارات أو

نصائح تتعلق بها. الغرض من مضاربة ومضاربة المالية هو لتقديم خدمات معلوماتية،

ولا تعرض بيع أو شراء أوراق ماليه. كما أن مضاربة المالية لا تضمن ولا تأكد أن

تكون المعلومات المقدمة في مضاربة دقيقة أو كاملة أو ملائمة. كما ولا تقدم

مضاربة المالية أي ضمانات أو توصيات بالاستثمار في الفرص المعروضة داخل

المنصة. يمكن الوصول الى مضاربة ومضاربة المالية عبر https://mudaraba.sa )) ومن

أجل استخدام الخدمة فإنه يلزم المستخدم الحصول على مدخل للشبكة العنكبوتية

بالإضافة إلى التزود بكافة المواد والأجهزة اللازمة للحصول على الشبكة

العنكبوتية، مثل جهاز الحاسب الآلي وجهاز التقاط شبكة الإنترنت وغيرها من

الأجهزة.

3. الملكية والملكية الفكرية وحقوق النشر:

مضاربة المالية هي المالكة لكافة حقوق النشر والطبع للمحتوى المتوفر على

الموقع الإلكتروني، وتشمل هذه الحقوق على سبيل المثال لا الحصر، (أ) كافة

المستندات والوثائق والمواد المتعلقة بالخدمات والمنتجات داخل المنصة. (ب)

جميع النصوص والمعلومات والبيانات والرسوم والخطط والأدوات البيانية والصور

والفيديوهات والخطوط والموسيقى والأصوات ورمز الـ (HTML) بالإضافة إلى كافة

الوجهات التي يحتوي عليها الموقع. (ج) التصاميم والاختيارات والتراتيب الخاصة

بالموقع. وبمجرد تقديم أو إرسال أي مادة تحتوي على اي نصوص أو معلومات أو

بيانات أو رسوم بيانية أو خطط بيانية، أو أدوات بيانية، أو صور أو فيديوهات أو

الخطوط أو المؤثرات الصوتية أو أصوات، (للأغراض الواردة في هذه الفقرة)

للمضاربة المالية، يُقر المستخدم بحقوق الملكية الفكرية التي يمنحها النظام

لـشركة مضاربة المالية بشكل دائم وحصري. ويترتب على تقديم أو إرسال اي محتوى

أو مضمون لشركة مضاربة المالية، التالي: (أ) يتعهد المستخدم بأن له الحق

الكامل في توزيع أو نشر ذلك المحتوى المُرسل. (ب) يتعهد المستخدم بتعويض شركة

مضاربة المالية عن كافة الأضرار في حالة ما إذا اعترض أحد على توزيع أو نشر

المستخدم لذلك المحتوى. سواءً نجح ذلك الاعتراض أم لم ينجح. (ج) يتعهد

المستخدم بأنه على دراية تامة بأن مضاربة المالية لها الحق في الاحتفاظ بتلك

المعلومات المرسلة من قبله وذلك لأسباب تتوافق مع سياسة الخصوصية الخاصة

بمضاربة المالية بالإضافة إلى أن تزويد المستخدم للمضاربة المالية بتلك الحقوق

يكون بشكل دائم. كما يجب ان يتوافق استخدام هذه الخدمات مع قوانين المملكة

العربية السعودية. وتنطبق هذه الشروط والأحكام على كافة مستخدمي الخدمات

المملوكة للمضاربة المالية.

4. الاستخدامات المسموح بها:

ما لم يُنص على خلاف ذلك، يتم منح المستخدم حقاً غير حصري وغير قابل للانتقال

أو التحويل لدخول واستخدام وعرض هذه المنصة وجميع المعلومات التي تقوم هذه

المنصة بتزويدها للمستخدم لاستخداماته للأغراض المعدة له. وفي حالة تحميل أي

محتوى من المنصة فلا يترتب على ذلك منح حق ملكية ذلك المحتوى بأي شكل من

الأشكال، كما لا يترتب عليه حق تعديل ذلك المحتوى أو استخدامه بأي استخدامات

أخرى غير المنصوص عليها. وتظل حقوق ملكية المحتوى مملوكة بالكامل للمضاربة

المالية أو الجهات التي تقوم بالترخيص لها. كما تحتفظ مضاربة المالية بجميع

الحقوق الغير ممنوحة للمستخدم صراحةً. ويتم منح حقوق استخدام المواد المملوكة

للمضاربة المالية بموجب حقوق الملكية والنشر للأغراض الأخرى الغير منصوص عليها

في هذه الشروط والأحكام، كل حالة على حِدة.

5. أغراض الاستخدام:

يستهدف الموقع الشريحة التالية من المستخدمين:

(1) المشاريع التجارية الباحثة عن خطط عمل أو رأس مال.

(2) المستثمرين المُحتملين الباحثين عن استثمارات في المشاريع.

(3) داعمي الأعمال والمشاريع الباحثين عن مشاريع وأعمال لدعمها.

(4) المشاريع الباحثة عن التسويق.

(5) المشاريع أو الأعمال التي ترغب في استخدام أعمال وحلول وبرمجيات مضاربة.

(6) رجال الأعمال والمستثمرين والشركات.

(7) جامعي البيانات.

(8) المستثمرين الأفراد "غير المتخصصين"، على ألا يتجاوز استثمارهم 20 الف

ريال سعودي في مجموع الإصدارات ذات العلاقة بكل كيان سنوياً، وألا يتجاوز في

جميع الأحوال، ما قدره 100الف ريال سعودي سنوياً في كافة الاستثمارات المعروضة

في المنصة.

ويمكن لطالبي التمويل و المشاريع القيام بعرض المعلومات الخاصة بها وذلك بغرض

تنظيمها حسابياً وعرضها للمراجعة من قبل داعمي المشاريع والمستثمرين

المحتلمين.

ويجب التنبيه إلى أن مضاربة والعاملين فيها ليسوا وكلاء أو ممثلين أو ضامنين

في استثمار في الأوراق المالية. إضافة إلى أن مضاربة والعاملين فيها لا

يتحملون أي مسؤولية عن مدى نظامية استثمارات كهذه وفق أنظمة السوق المالية في

المملكة العربية السعودية أو أي دولة اخرى. كما أن جميع المعلومات والبيانات

المطروحة والمزودة في هذا الموقع أو أي موقع آخر يرتبط بهذا الموقع مباشرة هي

تستخدم فقط لأغراض معلوماتية. ويجب ألا تحتوي أي مادة هنا على عرض بيع أو شراء

أو الحث على عرض للشراء من أي مستثمر أيًا كان مكان إقامته. كما لم تُصمم أي

مادة يحتوي عليها الموقع كقاعدة وحيدة لاتخاذ أي قرار استثماري. وينبغي على كل

مستثمر القيام بكافة واجباته والتزاماته القانونية واتخاذ العناية اللازمة

وسؤال الأسئلة وتلقي الإجابات والحصول على معلومات إضافية وإجراء العناية

اللازمة حول أي استثمار يقوم به. ويجب أن تتوافق جميع الاستثمارات مع الأنظمة

والقوانين في المكان الذي تتم فيه عملية شراء أو عرض أو بيع الأوراق المالية.

المنصة متاحة فقط للمستخدمين الذي يتمتعون بالأهلية الشرعية والقانونية

للاستفادة من خدمات المنصة، ويتحمل المستخدم لوحده المسئولية عن ثبوت خلاف

ذلك.

6. الاستخدامات الممنوعة:

(1) تعديل محتويات المنصة أو نشرها أو نقلها أو توزيعها أو عرضها أو أداءها أو

المشاركة في نقل أو بيع أو إنشاء أعمال ثانوية أو مشتقة بناءً على المنصة أو

استغلال المواد الموجودة عليها والمحمية بحقوق الملكية الفكرية بأي شكل من

الأشكال سواءً كان ذلك الاستغلال كلياً أو جزئيًا دون موافقة خطية مسبقة من

قبل مضاربة المالية (باستثناء ما هو منصوص عليه صراحة في هذه الشروط

والأحكام).

(2) استخدام هذه المنصة بواسطة الشركات الأجنبية والتي تقع خارج حدود المملكة

العربية السعودية. ويكون المستخدم مسؤولًا مسؤولية تامة وشخصية عن أي التزامات

وفقاً لقانون بلده.

(3) التأجير من الباطن أو تأجير أو بيع أو تنازل أو نقل أو توزيع أو مشاركة في

الاستخدام أو منح حقوق أي حقوق تُقدمها الخدمة أو أي مواد ووثائق ومستندات

متوفرة على هذا الموقع لأي طرف ثالث.

(4) القيام بتوفير استخدام مضاربة على أجهزة الحاسب الآلي المخصصة للخدمات أو

الشبكة أو التلفزيون التفاعلي المرتبط بالكيبل أو وحدة المعالجة المركزية

المتعددة أو تعاون المستخدمين المنظم مع المستخدمين الغير مرخصين بواسطة

مضاربة المالية. أو استغلال أي جانب من جوانب الوصول لمضاربة او المواد أو

الوثائق التي تقوم هذه المنصة بتزويدها استغلالا لأغراض تجارية.

(5) استخدام أي معلومات تم الحصول عليها من خلال هذه المنصة ومعلومات الاتصال

الخاصة بالمستثمرين لأي أسباب أخرى غير مذكورة في البند المتعلق بـ(أغراض

الاستخدام) الواردة في هذه الشروط والأحكام.

(6) القيام بعملية بيع أو محاولة بيع أو تنظيم محاولة تسويق مع طالبي التمويل

أو المستثمرين بخلاف التواصل المتعلق بالاستثمار في الفرصة الاستثمارية بغرض

ترويج فرص استثمارية أخرى أو المنافسة أو التواصل مع المستثمرين لغير الأسباب

الواردة في هذه الشروط والأحكام.

(7) التواصل مع المستثمرين أو المشاريع أو داعمي الأعمال لتسويق مواقع أخرى

تقدم خدمات منافسة لمضاربة.

(8) يترتب الاستخدامات الممنوعة الواردة في هذه الشروط والأحكام على: مصادرة

المشروع أو مصادرة حساب دعم المشروع وعدم قابلية استرداد الرسوم المدفوعة بذلك

الشأن. كما يحق للمضاربة المالية اتخاذ أي إجراء قانوني إضافي لاسترداد حقوق

الملكية الفكرية المفقودة بسبب ذلك.

(9) أي استخدام للمنصة ينجم عنه مخالفة الأنظمة واللوائح المعمول بها في

المملكة العربية السعودية.

7. العلامات التجارية:

تُستخدم العلامات التجارية عن طريق مضاربة المالية طبقاً للخدمة التي يريد

المستخدم الحصول عليها. وتبعاً لذلك فإن أي استخدام للعلامات غير المذكور

أعلاه يعد محظورًا حظر تام، دون الحصول على الموافقة الخطية المسبقة من مضاربة

المالية لاستخدام تلك العلامات. ويتم معاملة كل طلب للحصول على موافقة على

حده.

8. التعديلات:

تمتلك مضاربة المالية في أي وقت ومن حين لآخر وفقاً لتقديرها الخاص الحق في

تعديل أو إيقاف الخدمة بشكل مؤقت أو دائم (أو أي جزء من الخدمة بما في ذلك

إرسال أو نقل مواد أو وثائق ذات صلة). سواءً كان ذلك التعديل أو الإيقاف مع

وجود أو عدم وجود إشعار مسبق. إضافة الى ذلك، تمتلك شركة مضاربة المالية في أي

وقت ومن حين لآخر ووفقاً لتقديرها الخاص الحق بدون إشعار مسبق في تغيير أو

إنهاء أي محتوى أو مميزات موجودة على المنصة. كما يوافق المستخدم على أن شركة

مضاربة المالية غير مسؤولة تماماً نحوه أو نحو أي طرف ثالث جراء أي تعديل أو

تعليق أو إيقاف الخدمة أو المحتوى أو المميزات المتوفرة على هذه المنصة.

9. الصعوبات التي قد تواجه النظام:

تقوم شركة مضاربة المالية باستخدام أنظمة تطوير داخلي لخدماتها. هذه الأنظمة

قد تواجهه صعوبات تكنولوجية أو صعوبات أخرى. كما قد تواجهه أنظمة أجهزة الحاسب

الآلي والاتصالات بعض الانقطاعات. وبناء على ذلك، فإن مضاربة المالية تقوم

بشكل مستمر بتعزيز وتطوير هذه الأنظمة بالقدر الذي تواكب فيه مستوى استخدام

مضاربة. إضافة إلى ذلك، فإن مضاربة المالية قد تقوم بإضافة مميزات ووظائف أخرى

إضافية لخدماتها والتي قد تؤدي الى الحاجة إلى تطوير أو ترخيص تقنيات اخرى

إضافية. كما أن الاستخدام المتزايد لخدمة مضاربة قد ينتج عنه تزايد في حجم

التعاملات من خلال أنظمة المعالجة الخاصة أو توفير خدمات أو مميزات أو وظائف

جديدة تتسبب في حدوث اضطرابات غير متوقعة في النظام وبطء في الاستجابة وتدهور

في مستوى خدمة العملاء وتأخير في الإبلاغ عن المعلومات المالية الدقيقة.

10. دقة المعلومات:

في حال قيام المستخدم بالتسجيل في هذه الخدمة فإنه يتعهد بأن كافة المعلومات

والبيانات التي يزود المنصة أو الخدمة بها، صحيحة ودقيقة وحديثة وكاملة، كما

يتعهد بالحفاظ وتحديث هذه المعلومات للحفاظ على صحتها ودقتها وكمالها أثناء

استخدام مضاربة. وفي حال قيام المستخدم بتزويد المنصة ومضاربة بمعلومات غير

صحيحة أو غير دقيقة أو غير حديثة أو غير مكتملة أو أن ترى مضاربة المالية

-لأسباب معقولة- أن هذه المعلومات غير صحيحة أو غير دقيقة أو غير حديثة أو غير

مكتملة فإن مضاربة المالية لديها الحق في إيقاف أو تعليق أو إنهاء حساب

المستخدم، كما أنها تمتلك الحق في رفض جميع الاستخدامات أو جزء منها والتي

يقوم المستخدم بها على المنصة أو الخدمة سواء كانت حالية أو مستقبلية.

11. سياسة الخصوصية:

يدرك مستخدمي مضاربة أن مضاربة المالية تقوم بطلب وجمع البيانات الشخصية

للمستخدمين والتي تتضمن على سبيل المثال لا الحصر معلومات عن الهوية، معلومات

تجارية، معلومات مالية، معلومات مهنية وأي معلومات أخرى ترتبط بالمستخدمين ("ا لبيانات الشخصية"). تقوم مضاربة المالية بجمع واستخدام

ومعالجة وتخزين البيانات الشخصية. في حال عدم قيام المستخدم بـتزويد البيانات

الشخصية أو استكمال تزويد البيانات الشخصية لمضاربة المالية سيحد ذلك من قدرة

المستخدم على التسجيل أو الحصول على حساب أو استخدام خدمات مضاربة المالية.

ولا يمكن للمستثمر في هذه الحالة التعليق على فرصة استثمارية ولا الاستثمار من

خلال المنصة. ويعود للمستثمر مراجعة أو تغيير أو تحديث بياناته الشخصية من

خلال إعدادات حسابه.

ان جميع البيانات الشخصية هي سرية. تقوم مضاربة المالية اتخاذ الخطوات

والإجراءات المعقولة لضمان سرية البيانات الشخصية. وتتعهد مضاربة المالية بعدم

الافصاح عن البيانات الشخصية للغير الا وفقا لمتطلبات فرص الاستثمار، وذلك

حيثما يسمح أو يقضي به القانون. وتقوم مضاربة المالية (أ) الالتزام بمعالجة

البيانات الشخصية بالامتثال لجميع القوانين المعمول بها، و (ب) اتخاذ جميع

التدابير الفنية والتنظيمية المناسبة ضد أي معالجة غير مشروعة للبيانات

الشخصية وضد أي فقد عرضي أو إتلاف أو تسريب أو ضرر يلحق بالبيانات الشخصية.

تقوم مضاربة المالية بانتظام بمراجعة إجراءاتها الأمنية للنظر في التقنيات

والأساليب الجديدة المناسبة للحفاظ على سرية البيانات الشخصية مع العلم أنه لا

توجد إجراءات أمنية مثالية أو لا يمكن اختراقها.

12. سرية المعلومات

جميع المعلومات الشخصية والتجارية والمعلومات الخاصة بالمشاريع هي سرية للغاية

في مضاربة. ويتعهد المستخدمون والمستثمرون وطالبي التمويل بالحفاظ على سرية

المعلومات والبيانات التي يقدمونها، كما يتعهد المستثمرون وداعمي المشاريع

بالحفاظ على سرية المعلومات والبيانات التي يتلقونها من أي طرف عبر المنصة.

كما أنه يحظر على المستثمرين وداعمي المشاريع الإفصاح أو توزيع أو القيام

بمشاركة تلك المعلومات البيانات بأي طريقة أخرى مع طرف ثالث. وتتحمل المشاريع

وطالبي التمويل بشكل كامل مسؤولية جميع الأنشطة التي تتم بواسطة أسم المستخدم

وكلمة المرور التي يقومون باستخدامها. كما يجب على المستخدمين الالتزام ب (أ)

إبلاغ مضاربة المالية مباشرة عن اي استخدام غير مصرح به لأسم المستخدم أو كلمة

المرور أو أي محاولة لاختراق الأمان أو الحساب (ب) يلزم التأكد من تسجيل

الخروج في كل مرة يتم فيها الانتهاء من استخدم الحساب. وبناءً على ذلك فإن

مضاربة المالية غير مسؤولة عن أي خسائر أو أضرار تحصل بسبب عدم الالتزام بهذه

الشروط والأحكام.

13. تأمين الحساب:

لـلتقليل من خطر اختراق الحسابات، سوف يتم قفل حساب المستخدم في المنصة بعد

خمس محاولات دخول فاشلة وذلك لمدة (60) ستون دقيقة، بعد ذلك يتم تلقائيا إعادة

فتح قفل الحساب.

14. التسجيل:

قد تتطلب الخدمات التي تقدمها مضاربة المالية دفع رسوم استخدام. وتخضع رسوم

التسجيل والاستخدام للتحديث والتغيير دون إشعار مسبق. وفي حالة استلام بريد

إلكتروني يفيد التأكيد فإن ذلك لا يعني بأي حال من الأحوال قبول طلب التسجيل.

وتمتلك شركة مضاربة المالية وبدون إشعار مسبق الحق في رفض تسجيل أي مستخدم.

وقد تطلب مضاربة المالية التحقق من المعلومات أو البيانات قبل قبول عملية طلب

التسجيل بما في ذلك التحقق من بيانات ومعلومات البطاقة الائتمانية. ويمكنك

إلغاء طلب التسجيل بإرسال رسالة إلى [email protected]

15. تأمين التعاملات عبر الإنترنت:

تقوم مضاربة المالية بكافة الجهود اللازمة لتأمين كافة المعاملات التي تتم عبر

المنصة. ولمعرفة المزيد من التفاصيل حول كيفية قيام مضاربة المالية بحماية

أمان وجودة معلومات المستخدم الخاصة فإنه يمكن معرفة ذلك عن طريق الاطلاع على

سياسة الخصوصية الخاصة بها. وتستخدم مضاربة وسائل تأمين متطورة عبر المفاتيح

العامة والمفاتيح الخاصة. فيستخدم المفتاح العام لتشفير المعلومات ويمكن

للمستخدم باستخدام المفتاح الخاص بفك ذلك التشفير. بعد ذلك يمكن للمستخدم

البدء في إجراء التعاملات المؤمنة والتي تضمن نزاهة وخصوصية الرسائل. وفي حالة

اكتشاف المستخدم لأي نشاط قد يكون احتيالي على البطاقة الائتمانية، نرجو سرعة

التواصل مع البنك الخاص بتلك البطاقة الائتمانية وإبلاغهم.

16. سياسة الموافقة على حسابات المستخدمين:

تمتلك مضاربة المالية الحق في عدم قبول الحسابات الشخصية التي لا تتوافق مع

معايير الجودة والسياسات الخاصة بمضاربة المالية. وتخطر مضاربة المالية عن أي

تغيير أو تحديث يطرأ على أي حساب شخصي، ويحق لمضاربة المالية عدم قبول إنشاء

أو تحديث أي حساب. ولمعرفة كيف يتم الموافقة على حساب المستخدم من عدمها،

يمكنكم التواصل مع مضاربة المالية عبر [email protected]

17. التسعير وعملية الدفع:

يتم تسعير الاستثمار بناءً على طريقة الدفع التي يختارها المستخدم للاستثمار

كما هو موضح في صفحة الحملة. وفي مقابل الخدمات التي تقدمها مضاربة، فإنه يلزم

المستخدم الموافقة على دفع مبالغ الاستثمار المنصوص عليها. وفي حال تواجد أي

استفسارات حول ذلك فإنه يمكن التواصل مع مضاربة عبر [email protected]

18. سياسة الإلغاء واسترجاع المبالغ:

يجب التنويه على أن المبالغ المدفوعة للاستثمار غير قابلة للاسترداد أو

الإلغاء. تقوم مضاربة المالية بإعادة المبالغ المستثمرة للمستثمرين فقط في

حالة عجز الفرصة الاستثمارية عن تغطية الحد الأدنى من المبلغ المطلوب تغطيته

لكل استثمار. وفي حال تواجد أي استفسار فإنه يمكن التواصل مع مضاربة عبر [email protected]

19. المواقع ذات الصلة:

قد تتضمن هذه المنصة روابط لصفحات أو مواقع أخرى مملوكة أو مُشغلة بواسطة طرف

ثالث (المواقع ذات الصلة). مضاربة المالية لا تملك أي حق أو مسؤولية في التحكم

أو إدارة شروط الاستخدام أو السياسات الخاصة بتلك المواقع أو الصفحات. كما أن

مضاربة المالية لا تصادق على ما تقدمه تلك المواقع أو الصفحات من محتوى أو

إعلان أو منتج أو خدمة أو غير ذلك من مواد. كما أن المستخدم يقر بأن مضاربة

المالية غير مسؤولة بشكل مباشر أو غير مباشر عن أي ضرر أو خسارة ناجمة عن أو

تتعلق باستخدام أو الاعتماد على تلك المحتويات أو الإعلانات أو المنتجات أو

الخدمات أو غيرها من المواد التي تقدمها تلك المواقع والصفحات الخارجية ذات

الصلة. ويجب التواصل مع المسؤولين أو المشرفين أو المشغلين لتلك الصفحات

والمواقع الخارجية في حال وجود أي استفسارات بشأن صفحاتهم ومواقعهم.

20. معلومات الملف الشخصي العام:

قد تقوم مضاربة المالية بمشاركة معلومات حساب المستخدم العامة مع طرف ثالث

وذلك بغرض التسويق. ويكون الطرف الثالث مقيد بهذه الشروط والأحكام عند

استخدامه تلك المعلومات. وتلتزم مضاربة المالية بعدم نشر معلومات حساب

المستخدم العامة في حال ما إذا رفض نشر معلومات حسابه العامة مع أطراف أخرى.

21. قواعد تأمين الصفحة:

يُحظر على أي مستخدم اختراق أو محاولة اختراق الأمان لهذه المنصة، وتشمل أفعال

الاختراق أو محاولة الاختراق على سبيل المثال لا الحصر: (أ)الوصول إلى معلومات

أو بيانات لا تخص المستخدم أو تسجيل الدخول لحساب غير مصرح بتسجيل الدخول

إليه. (ب) أي محاولة إطلاع أو استكشاف أو اختبار قوة أو ضعف نظام الشبكة أو

خرق أو محاولة خرق أمان الشبكة أو نظام التوثيق دون إذن أو تصريح مسبق، أو

محاولة التداخل مع مستخدم آخر أو مع مُستضيف أو مع شبكة أخرى. وقد ينتج عن

انتهاك أمان الشبكة أو النظام مسؤولية جنائية أو مدنية. وسوف تبذل مضاربة

المالية كل الجهود الممكنة لتعقب ومتابعة أي انتهاك للنظام أو الأمان وتطبيق

القوانين على المُنتهكين بالتعاون مع محاكم بلد المُنتهك.

22. التجارة الإلكترونية الآمنة:

تعتمدان التجارة والتواصل عبر الإنترنت على نقل المعلومات السرية نقلاً آمناً

عبر الشبكات العامة. وبناءً على ذلك، قد تقوم مضاربة المالية بالاعتماد على

تقنية تشفير وتوثيق مرخصة من طرف ثالث وذلك لتوفير تكنولوجيا الأمان والتوثيق

لعمليات نقل آمنة للمعلومات السرية. وكما أنه لا يوجد ما يضمن حتى مع التقدم

في قدرات الحاسب الآلي أو الاكتشافات الجديدة في مجال التشفير أو التطورات

والأحداث الأخرى، عدم إمكانية أن يتم اختراق التكنولوجيا المستخدمة بواسطة

مضاربة المالية لتأمين معلومات عمليات العملاء. كما أن نظام الأمان المتبع

والمستخدم من قبل مضاربة المالية لا يضمن عدم حدوث أي اختراق.

23. الإبلاغ عن الانتهاكات:

يتعهد المستخدمين على إبلاغ مضاربة المالية بكل واقعة مشبوهة تشمل وصول أو

إفصاح أو كشف أو تعديل أو إضاعة أو إتلاف أو إضرار للمعلومات.

24. الرقابة:

يمكن مراقبة أو فحص أو حفظ أو قراءة أو نسخ أو تخزين أو إعادة إرسال جميع

الاتصالات الإلكترونية والمحتوى المقدم وذلك خلال العمليات اليومية التي يقوم

بها موظفي ووكلاء مضاربة المالية المخولين بذلك أثناء ممارستهم واجباتهم

ومهامهم أو بواسطة الجهات النظامية المختصة التي يُطلب منها مساعدة مضاربة

المالية في عمليات التحقيق في مخالفة محتملة. كما أنه يمكن فحص الاتصالات

الإلكترونية والمحتوى عبر وسائل الفحص الإلكتروني. علاوة على ذلك، تمتلك

مضاربة المالية الحق الكامل في رفض أي اتصالات إلكترونية أو محتوى تعتبرها غير

متوافقة مع السياسات والإجراءات المتبعة في مضاربة المالية.

25. سياسة الإيقاف والإلغاء:

في حالة ما إذا تم اعتبار أي مستخدم لمضاربة قام بانتهاك أياً من هذه الشروط

والأحكام (شروط وأحكام الاستخدام) فإنه يحق للمضاربة المالية ووفقاً لتقديرها

الخاص إيقاف أو إنهاء الحساب وكلمة المرور (أو أي جزء متعلق بذلك) والوصول إلى

مضاربة أو المنصة. ويوافق المستخدم على أن الإنهاء أو الإيقاف أو أي حذف

لمعلومات متعلقة بحساب المستخدم قد تتم دون إشعار مسبق. وفي حال الإنهاء،

يوافق المستخدم على إتلاف أي نسخ تحتوي على أجزاء من المحتوى المتوفر في

المنصة. وأخيراً، يوافق المستخدم على أن مضاربة المالية غير مسؤولة تماماً

اتجاه أي مستخدم أو طرف ثالث عن أي تعليق أو إنهاء أو إيقاف الوصول إلى الخدمة

أو المنصة أو عن أي حذف تقوم به لأي معلومات تتعلق بحساب المستخدم. وتعد جميع

النصوص التي تتعلق بإخلاء مسؤولية مضاربة المالية وما يتعلق بتعويضها عن

الأضرار المذكورة في شروط وأحكام الاستخدام هذه سارية حتى بعد إنهاء أو انتهاء

العلاقة مع المستخدم.

26.

مسؤولية المستخدمون في التقيد بأنظمة ولوائح المملكة العربية السعودية

:

يقر المستخدم ويلتزم بكافة القوانين والأنظمة واللوائح في المملكة العربية

السعودية عند استخدام هذه الخدمة بما في ذلك على سبيل المثال لا الحصر: القيام

بتعبئة وتقديم جميع النماذج والأوراق اللازمة المفروضة من هيئة السوق المالية

أو أي جهات أخرى رسمية والتأكد من اعتماد تلك الجهات للمستثمرين، وإدراج

البيانات والمعلومات اللازمة والمطلوبة من تلك الجهات وإخلاء المسؤولية

المتعلق بالاتصالات مع المستثمرين وغيرها من الإجراءات النظامية المنصوص عليها

بموجب أنظمة ولوائح هيئة السوق المالية. كما يتعهد على معرفته التامة بأن

مضاربة المالية ليست جهة تقدم استشارات قانونية أو محاسبية أو ضريبية. وجميع

المعلومات المقدمة من مضاربة والمتعلقة بقوانين الأوراق المالية هي فقط مقدمة

بغرض نشر الثقافة القانونية ولا تعتبر بمثابة استشارات قانونية يعتمد عليها

المستخدم. كما يتعهد ويضمن كل مستخدم وجود مستشار قانوني يتولى جميع استشارته

النظامية والقانونية قبل وأثناء استخدام مضاربة أو أي محتوى يقدم من خلالها.

كما أن المستخدم على علم ودراية بأن مضاربة المالية تخضع لمتطلبات هيئة السوق

المالية لناحية الالتزام بجميع أنظمة غسل الأموال واللوائح المعمول بها في

المملكة العربية السعودية. وفي سياق الجهود المبذولة في هذا الشأن يُقّر

المستخدم ويوافق على ان جميع الأموال، وأي جزء منها، المستخدمة من قبله للوفاء

بالتزاماته الرأسمالية بشأن الاستثمار من خلال هذه المنصة لم ولن تستمد، وذلك

بصورة مباشرة او غير مباشرة او فيما له علاقة باي نشاط قد يخالف الأنظمة. ويقر

كذلك أنه مستعد بشكل دائم لتوفير أية معلومات إضافية يمكن أن تطلبها مضاربة

الماليةو/أو الشركة المراد الاستثمار فيها للالتزام بالأنظمة واللوائح المعمول

بها وأية استفسارات إضافية خاصة بنظام "إعرف عميلك" (KYC) التي تقوم بها

مضاربة المالية.

27. إخلاء المسؤولية:

تُخلي مضاربة المالية مسؤوليتها عن ضمان أو تمثيل أي محتوى تحتوي عليه الخدمة.

ومن ذلك على سبيل المثال لا الحصر: (أ) الضمانات المتعلقة بالتسويق أو

الاستخدام لأغراض معينة بما في ذلك (قرارات الاستثمار) سواءً كانت أو لم تكن

مضاربة المالية على دراية أو لديها أسباب دراية أو أنه تم تقديم المشورة لها

مسبقاً بهذا الشأن. (ب) عدم ضمان أي نتائج يتم التوصل أو الحصول عليها من خلال

استخدام خدمة أو محتوى أو البيانات المتوفرة على مضاربة. كما أنه لا يجوز بأي

حال من الأحوال تفسير المحتوى أو الخدمات التي تقدمها مضاربة على أنها

استشارات استثمارية أو آراء من مضاربة المالية عن مدى ملائمة أي مشروع

استثماري. كما لا يمكن تفسير المحتوى والخدمات المقدمة من مضاربة على أنها

توصية أو تسويق أو حث أو مصادقة من مضاربة المالية على عرض معين لشراء أو بيع

أوراق مالية بشكل عام. ولا تكون مضاربة مسؤولة عن أي قرار استثماري مبني أو

مستمد من المحتوى أو الخدمات أو النتائج المستمدة أو المتوفرة على مضاربة. كما

أن المحتوى المتوفر على مضاربة هو فقط لأغراض معلوماتية، ولا يمكن العمل أو

الاعتماد عليه وحده دون مشورة قانونيه أو تجارية. وقد تم جمع الخدمات بناءً

على أوضاع سابقة ولا ينبغي الاعتماد عليها في التنبؤ بالأوضاع المستقبلية.

مضاربة غير مسؤولة تماماً عن أي خسائر تتعلق بالمحتوى أو الخدمات المقدمة على

مضاربة والناتجة عن المسؤولية العقدية أو التقصيرية أو غيرها، سواءً كانت بشكل

مباشر أو غير مباشر بما في ذلك على سبيل المثال لا الحصر: خسارة أرباح أو

إيرادات، أو أي خسارة اقتصادية أو تجارية لأي قرار يتم اتخاذه بناءً على

المحتوى والخدمات المقدمة على مضاربة. (ج) عدم تمثيل أو ضمان أن كل محتوى على

مضاربة ملتزم بالمتطلبات والالتزامات المنصوص عليها في الأنظمة والقوانين مثل

أنظمة ولوائح هيئة السوق المالية أو غيرها من الأنظمة واللوائح (د) كما يقر

المستخدم ويعترف أن الشركة غير مسؤولة عن أية بيانات غير صحيحة يتم توفيرها

على المنصة من قبل أشخاص ثالثين من ضمنها على سبيل المثال لا الحصر أية

معلومات تصدر عن شركة صغيرة ومتوسطة الحجم بصفتها مضارب في عقد المضاربة

الثاني المبرم مع المنشأة ذات الغرض الخاص.

28. تحديد المسؤولية:

لا تتحمل مضاربة المالية بأي حال من الأحوال المسؤولية عن أي أضرا ر مباشرة أو

غير مباشرة أو تأديبية أو عرضية أو تبعية (سواءً مسؤولية عقدية أو تقصيرية أو

غيرها) والناتجة عن المحتوى أو الخدمات الموجودة على مضاربة بما في ذلك على

سبيل المثال لا الحصر: الأضرار الناتجة عن الخسائر في الأرباح او العائدات،

الأضرار الناتجة عن البيانات التالفة أو المفقودة، الأضرار الناتجة عن

الفيروسات وغيرها من البرامج والبيانات المضرة، الأضرار الناتجة عن شبكات

وصفحات الإنترنت، أي أضرار ناتجة عن خسائر اقتصادية أو تجارية، الأضرار

الناتجة عن قرارات يتخذها أي طرف وذلك اعتماداً على الخدمة أو محتواها أو

نتائجها، أي أضرار نتجت عن تأخير أو فشل أو انقطاع أو تلف في أي بيانات أو

معلومات يتم إرسالها وتتعلق باستخدام الخدمة، أي أضرار ناتجة عن معلومات غير

دقيقة أو أخطاء أو نسيان ومتعلقة بالمحتوى والخدمات المقدمة على مضاربة. وفي

كل الأحوال، فإنه يجب ألا يتجاوز إجمالي مسؤولية مضاربة المالية وموظفيها

ووكلائها وممثليها فيما يتعلق بالمحتوى والخدمات المقدمة على مضاربة مبالغ

رسوم التسجيل ورسوم المستخدم المدفوعة مقابل استخدام الخدمة، سواءً كانت

المسؤولية تقصيرية أو عقدية.

29. التعويضات:

يلتزم كل مستخدم بتعويض مضاربة المالية عن أي مطالبات أو إجراءات أو طلبات أو

التزامات أو تسويات بما في ذلك على سبيل المثال لا الحصر: جميع الرسوم

القانونية والمحاسبية الناتجة عن انتهاك المستخدم لهذه الشروط والأحكام.

30. سياسة تضارب المصالح:

أ.

تطبيق سياسة تضارب المصالح:

لا تخل هذه السياسة بما ورد في الأنظمة واللوائح المطبقة في المملكة العربية

السعودية المتعلقة بتضارب المصالح ولا تحل محلها بل تعتبر هذه السياسة متممة

لها. تطبق هذه السياسة على حالات تعارض المصالح وتعاملات الأطراف ذوي العلاقة

طبقاً للأحكام الواردة أدناه.

ب. أهداف سياسة تضارب المصالح: تهدف هذه السياسة إلى الآتي:

1. حماية مصالح مضاربة المالية والمنصة والمستثمرين وطالبي التمويل من خلال

تنظيم حالات تعارض المصالح المحتملة والفعلية بين مضاربة المالية والأطراف ذو

العلاقة وبين طالبي التمويل والمستثمرين.

2. الوصول بـالمنصة إلى أقصى معايير الشفافية بـهدف الحصول على ثقة المستخدمين

والحد من حالات تعارض المصالح في أنشطة مضاربة المالية والمنصة من خلال تنظيم

تعامل الشركة مع الأطراف ذوي العلاقة.

3. تفادي تأثير المصلحة الشخصية أو العائلية أو المهنية لأي شخص ذو علاقة على

أداء واجباته تجاه مضاربة المالية أو تجاه المستخدمين.

ت.

مفهوم تضارب المصالح:

يحدث تضارب المصالح الفعلي أو المحتمل في الحالات الآتية:

1. عندما تتعارض مصلحة خاصة بأي طرف ذو علاقة مع المصلحة العامة للشركة أو على

النحو الذي قد يؤثر على مصالح المستثمرين أوطالبي التمويل أو المستخدمين

المتعاملين مع المنصة في سياق أعمال الشركة.

2. عندما يقوم أي من الأطراف ذو علاقة باتخاذ قرارات أو لديهم مصالح تحول دون

أدائهم لعملهم بموضوعية وفعالية.

3. عندما يقوم أي من الأطراف ذو علاقة بتلقي منافع شخصية لموقعهم في الشركة.

ث. حالات تضارب المصالح:

1. تملك أسهم في أي طالب تمويل تستضيفه المنصة.

2. دفع مبالغ لأي شخص يحيل أو يقوم بالتعريف بطالب تمويل جديد من أجل استضافته

بالمنصة، أو استقبال دفعات بأي شكل من الأشكال بما فيها الحصول على حصص أسهم

في طالب التمويل مقابل إحالته أو التعريف به للمنصة.

3. شغل عضوية مجلس إدارة طالب تمويل تستضيفه المنصة أو في أي جهة مستقلة تقدم

خدمات الفحص النافي للجهالة أو التقييم أو المشورة لطالب التمويل.

4. شغل منصب في طالب تمويل تستضيفه المنصة أو في أي جهة مستقلة تقدم خدمات

الفحص النافي للجهالة أو التقييم أو المشورة لطالب التمويل.

5. تملك مضاربة المالية أو أي من موظفيها لحصة السيطرة في أي جهة مستقلة تقدم

خدمات الفحص النافي للجهالة أو التقييم أو المشورة للمصدر.

ج. معالجة تضارب المصالح: في حال نشوء أي من حلات التضارب

السابقة، فيجب حلها ومعالجتها بالآتي:

1. إفصاح الشركة ذات العلاقة بحالة التضارب لمضاربة المالية عن حالة التضارب

الفعلي أو المحتمل، وعن أثر تلك الحالة على تعاملات تمس الجمهور وذلك قبل

اعتماد أي فرصة استثمارية وعرضها على المنصة.

2. إفصاح مضاربة المالية للجمهور من خلال الموقع الإلكتروني عن حالة التضارب

الفعلي أو المحتمل، وعن أثر تلك الحالة على أي تعاملات تمس الجمهور.

ح.

تطبيق السياسة:

1. تتولى المنصة ومجلس إدارة مضاربة المالية تفسير هذه السياسة والإشراف عليها

والتأكد من تنفيذها والعمل بموجبها وإجراء التعديلات اللازمة عليها.

2. لا يكون الشخص في حالة تعارض مصالح إلا إذا قررت مضاربة المالية أو المنصة

أن الحالة تنطوي على تعارض مصالح وذلك فيما يخص معاملات مضاربة المالية أو

المنصة مع الغير.

3. يجوز للمنصة أو مضاربة المالية وفقا لسلطتها التقديرية أن تقرر في كل حالة

تنطوي على تعارض مصالح على حدة بـشأن الإعفاء من مسؤولية تعارض المصالح الذي

قد تنشأ عَرضًا من حين إلى آخر في سياق نشاطات الشخص وقراراته المعتادة، أو

التي قد تنشأ في سياق عمله مع مضاربة المالية، سواء فيما يتعلق بمصالح مالية

أو أمور تُعيقه عن القيام بواجبه في التصرف على أكمل وجه بما يراعي مصالح

مضاربة المالية .

4. لمضاربة المالية الحق في إيقاع الجزاءات على مخالفي هذه السياسة من

المعنيين أو الغير وفقًا لهذه السياسة، كما يحق لها إحالة جميع المخالفين -من

موظفيها أو غيرهم- إلى الجهات المختصة لمطالبته بالتعويض عن الأضرار التي قد

تنجم عن عدم التزامهم بأحكامها.

5. لمضاربة المالية إبلاغ الهيئة والجمهور عن تعاقدات المنصة أو لمضاربة

المالية أو تعاملها مع أي طرف ذي علاقة وفقا لنظام الشركات ولوائح هيئة السوق

المالية وسياسة الإفصاحات الخاصة بمضاربة المالية.

خ.

التزامات الأطراف ذات العلاقة بسياسة تضارب المصالح

:

1. الاطلاع على هذه السياسة والتقيد بأحكامها وملحقاتها وأي تحديثات تطرأ

عليها.

2. عدم استغلال منصبه لتحقيق مصالح خاصة، والقيام بالأعمال والالتزامات

المترتبة عليه تجاه مضاربة المالية على نحو مستقل وخال من أي تعارض فعلي أو

محتمل بين مصالح مضاربة المالية ومصالحه الشخصية، وأن يقدم دوما مصلحة مضاربة

المالية على أي مصلحة أخرى وفق متطلبات هذه السياسة.

3. اجتناب حالات تعارض المصالح ما أمكن، والتقيد بطرق معالجتها إذا حدثت.

4. عدم إساءة استخدام أصول مضاربة المالية ومرافقها وممتلكاتها.

5. الحفاظ على سرية المعلومات غير العامة أو السرية وعدم إفشائها أو استغلالها

لتحقيق مصالح شخصية.

31. الاختصاص المكاني:

لا تضمن مضاربة المالية أن يكون المحتوى المقدم على الموقع الإلكتروني مناسباً

لأن يقدم خارج المملكة العربية السعودية. وقد يكون الوصول إلى المحتوى غير

قانوني في بعض الدول وبواسطة أشخاص معينين في تلك الدول. وفي حال قيام أي

مستخدم بالدخول على المحتوى من أي دوله من تلك الدول، فإنه يتحمل المسؤولية

كاملة عن الأضرار والمخاطر الناجمة عن ذلك. كما يتحمل كل مستخدم مسؤولية

الامتثال وتطبيق قوانين الدولة المتواجد عليها.

32. القوانين واجبة التطبيق; التحكيم:

تخضع هذه الأحكام الشروط لأنظمة وقوانين المملكة العربية السعودية. وتختص هيئة

تحكيم مكونة من محكم واحد في مدينة الرياض، المملكة العربية السعودية بالنظر

في أي نزاع ينشأ عن هذه الشروط والأحكام.

33. بطلان أحد الشروط أو الأحكام:

في حال الحكم ببطلان أو عدم قابلية تنفيذ أحد البنود المنصوص عليها في هذه

الشروط والأحكام فإن ذلك لا يؤثر على بقية الشروط والأحكام. وفي حال تم الحكم

ببطلان جزء من أحد هذه الشروط والأحكام فإن ذلك الشرط أو الحكم يعد لاغيًا ولا

يؤثر على بقية الشروط والأحكام الصحيحة.

34. رفع التقارير:

يتحمل رواد أعمال/طالبي التمويل لدى مضاربة مسؤولية رفع تقارير عن حجم التمويل

والمعلومات والبيانات الأخرى، انطلاقاً من مسؤوليتهم ببذل العناية اللازمة.

وفي حال تواجد أي أسئلة حول صحة تلك المعلومات والبيانات فيرجى التواصل مع

مضاربة المالية عبر [email protected] حتى نتكمن من اتخاذ الإجراءات اللازمة.

35. أتعاب مضاربة المالية:

يقر العميل ويوافق على أنه مقابل قيام الشركة بتقديم خدماتها كراعي للمنشأة

ذات الغرض الخاص ووصي للمنشأة ذات الغرض الخاص، تقوم المنشأة ذات الغرض الخاص

بناء للقواعد المنظمة للمنشات ذات الأغراض الخاصة بالدفع للشركة أتعاب اضافية

مقابل هذه الخدمات، كما هو منصوص عليه ضمن العقد المبرم فيما بين الشركة و

المنشأة ذات الغرض الخاص.

36. أحكام عامة:

(أ) تعتبر هذه الشروط والأحكام هي العقد الكامل بين كل مستخدم ومضاربة

المالية. كما تعتبر هذه الشروط والأحكام هي الحاكمة لاستخدام مضاربة والموقع

الإلكتروني والخدمات المقدمة من مضاربة المالية وتحل محل جميع الاتفاقيات

الشفهية أو الكتابية السابقة بين المستخدمين وشركة مضاربة المالية.

(ب) كما يخضع استخدام الموقع لسياسات الخصوصية والعلامات التجارية.

(ج) كما لا يعتبر عدم تمكن مضاربة المالية من ممارسة أحد حقوقها المنصوص عليها

في هذه الشروط الأحكام تنازلاً منها عن ذلك الحق أو اي حق آخر بناء على هذا

الحق.

(د) يحق للمضاربة المالية تحصيل كافة النفقات المدفوعة بما في ذلك أتعاب

المحاماة وذلك في سبيل تنفيذ حقوقها المنصوص عليها في هذه الشروط والأحكام.

(ه) بمجرد استخدام هذا الموقع والأدوات المرتبطة به فإن المستخدم يتفق على أن

جميع المقاييس تم إنشاؤها بواسطة جهاز الحاسب الآلي وهي مقاييس موضوعية وليست

شخصية وليس بالضرورة أن تكون مصممة وفقاً لمعايير المستخدم الاستثمارية أو

المخاطر التي تددها أو حاجات استخدامك.

(و) يتعهد المستخدم بتعويض مضاربة المالية عن أي أضرار أو خسائر ناتجة عن

استخدامه لمضاربة أو عن القرارات الاستثمارية أو عن أي اضرار أو خسائر اخرى

تتعلق بالاستخدام أو المعلومات أو البيانات.

(ز) لا ينبغي اتخاذ قرار الاستثمار بناءً على المواد المطروحة على المنصة فقط.

(ح) جميع الأرقام معدة من الشركات الصادرة منها ولا تخضع للتحقق.

(ط) يلزم المستثمرون بذل العناية اللازمة عليهم أثناء استخدامهم للموقع.

(ي) لا تقوم مضاربة المالية أو مضاربة أو المواقع المتصلة بها في أي وقت ولأي

سبب بإنشاء أوعداد أي اوراق مالية.

ولمعرفة الزيد عن مخاطر الاستثمار، يمكنك زيارة https://mudaraba.sa/risk

.

(ك) بمجرد استخدام مضاربة فإن المستخدم يتعهد على أنه على دراية كاملة بأن

مضاربة مجرد موقع يقدم معلومات تقديمية فقط.

(ل) يلتزم المستخدم بتعويض مضاربة وجميع شركائها عن أي خسائر أو اضرار تلحق

بهم نتيجة الخسائر في الاستثمار.